All Categories

Featured

Table of Contents

Investor with a special legal status An approved or advanced investor is an capitalist with a special standing under economic law regulations. The definition of a certified investor (if any kind of), and the consequences of being classified therefore, range nations - qualified investor criteria. Generally, recognized investors include high-net-worth people, banks, banks, and various other large corporations, who have access to complicated and higher-risk investments such as venture funding, hedge funds, and angel investments.

It specifies sophisticated investors to ensure that they can be dealt with as wholesale (as opposed to retail) customers. According to ASIC, a person with an advanced capitalist certificate is a sophisticated financier for the function of Chapter 6D, and a wholesale customer for the purpose of Phase 7. On December 17, 2014, CVM released the Directions No.

A corporation integrated abroad whose tasks resemble those of the companies established out above (accredited investor ipo). s 5 of the Securities Act (1978) defines an innovative capitalist in New Zealand for the objectives of subsection (2CC)(a), an individual is affluent if an independent legal accountant licenses, no greater than year before the deal is made, that the chartered accountant is satisfied on practical grounds that the person (a) has internet properties of a minimum of $2,000,000; or (b) had a yearly gross income of at the very least $200,000 for every of the last 2 economic years

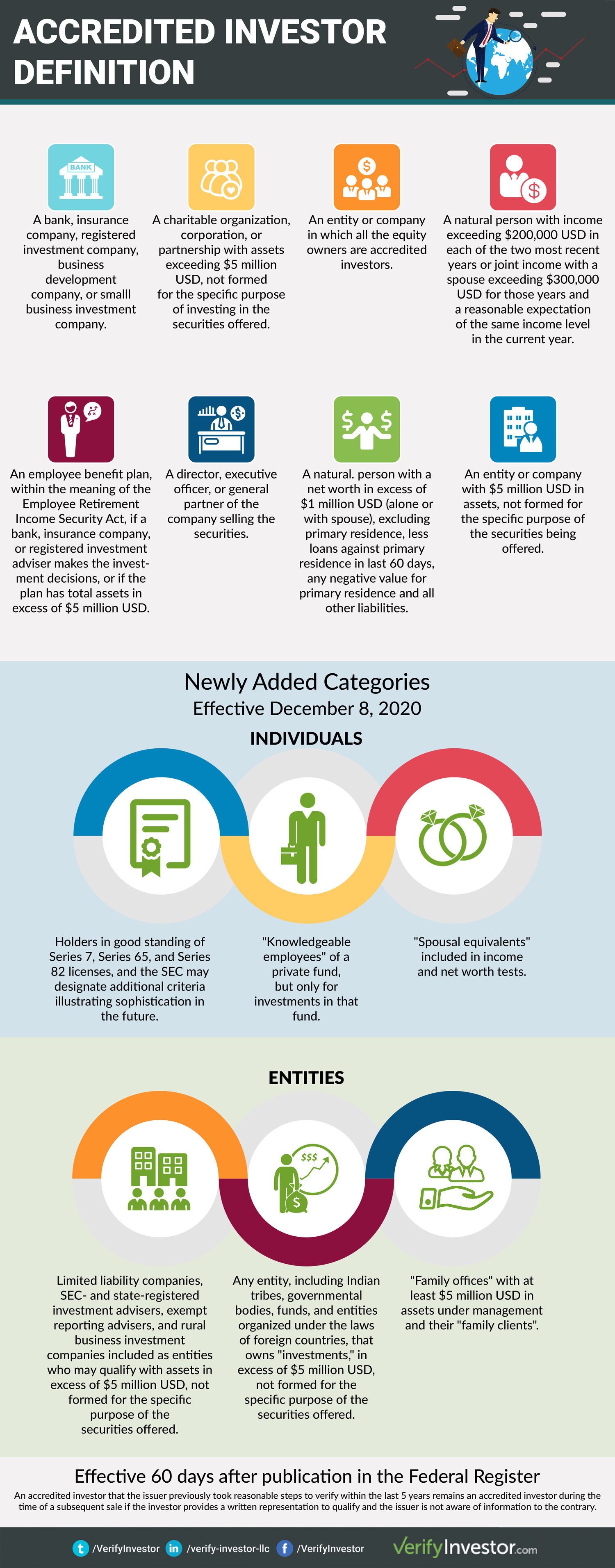

More precisely, the term "certified financier" is defined in Policy 501 of Regulation D of the U.S. Securities and Exchange Commission (SEC) as: a bank, insurer, registered investment company, service development firm, or small company investment firm; a fringe benefit strategy, within the significance of the Staff Member Retirement Earnings Security Act, if a bank, insurer, or registered investment consultant makes the investment choices, or if the plan has total properties in unwanted of $5 million; a charitable organization, firm, or collaboration with assets exceeding $5 million; a supervisor, executive officer, or general partner of the firm offering the safety and securities; a company in which all the equity owners are accredited financiers; a natural person that has specific web well worth, or joint total assets with the individual's partner, that exceeds $1 million at the time of the purchase, or has possessions under monitoring of $1 million or above, excluding the worth of the person's main house; an all-natural individual with revenue exceeding $200,000 in each of the two most current years or joint income with a spouse surpassing $300,000 for those years and a practical assumption of the very same income degree in the current year a count on with possessions over of $5 million, not created to acquire the protections supplied, whose purchases an innovative person makes. "Spousal equivalent" to the accredited financier meaning, so that spousal equivalents might pool their funds for the objective of qualifying as certified financiers. Obtained 2015-02-28."The New CVM Instructions (Nos.

Accredited

17 C.F.R. sec. BAM Funding."Even More Investors May Get Access to Private Markets.

Approved investors consist of high-net-worth individuals, financial institutions, insurance provider, brokers, and counts on. Approved capitalists are defined by the SEC as qualified to spend in facility or advanced sorts of safeties that are not closely regulated - investor eligibility. Certain standards need to be met, such as having a typical yearly income over $200,000 ($300,000 with a spouse or cohabitant) or operating in the monetary industry

Non listed securities are inherently riskier due to the fact that they do not have the typical disclosure demands that come with SEC registration., and various offers involving complicated and higher-risk financial investments and tools. A firm that is looking for to raise a round of financing may determine to straight approach certified capitalists.

It is not a public firm but wants to introduce a preliminary public offering (IPO) in the future. Such a company might determine to provide protections to certified investors directly. This kind of share offering is described as a private positioning. accredited investor net worth. For certified financiers, there is a high potential for danger or reward.

Certified Investor

The laws for certified investors vary amongst jurisdictions. In the U.S, the meaning of a certified capitalist is presented by the SEC in Guideline 501 of Regulation D. To be an accredited capitalist, a person must have an annual earnings surpassing $200,000 ($300,000 for joint revenue) for the last 2 years with the expectation of gaining the very same or a greater earnings in the current year.

This quantity can not consist of a main residence., executive policemans, or directors of a firm that is providing non listed securities.

Sec Certification Requirements

Also, if an entity includes equity owners that are approved financiers, the entity itself is an accredited investor. A company can not be developed with the single function of purchasing particular securities. A person can qualify as an accredited financier by showing adequate education or job experience in the financial sector.

People who want to be certified investors don't put on the SEC for the designation. accredited investor qualified purchaser. Instead, it is the obligation of the business providing a private positioning to make certain that all of those approached are approved financiers. Individuals or events who want to be accredited financiers can approach the provider of the non listed safety and securities

Required Investors

Mean there is an individual whose income was $150,000 for the last 3 years. They reported a key house worth of $1 million (with a home mortgage of $200,000), an auto worth $100,000 (with an outstanding lending of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

This person's web worth is precisely $1 million. Because they meet the internet well worth requirement, they qualify to be an accredited capitalist.

There are a few much less typical qualifications, such as taking care of a trust with even more than $5 million in properties. Under government protections regulations, just those that are certified capitalists might join particular safeties offerings. These may consist of shares in exclusive placements, structured products, and exclusive equity or hedge funds, among others.

Table of Contents

Latest Posts

Tax Lien Investing Secrets

Back Taxes Homes

Find Unpaid Property Taxes

More

Latest Posts

Tax Lien Investing Secrets

Back Taxes Homes

Find Unpaid Property Taxes